Slide 1 - Slide 1

Slide notes

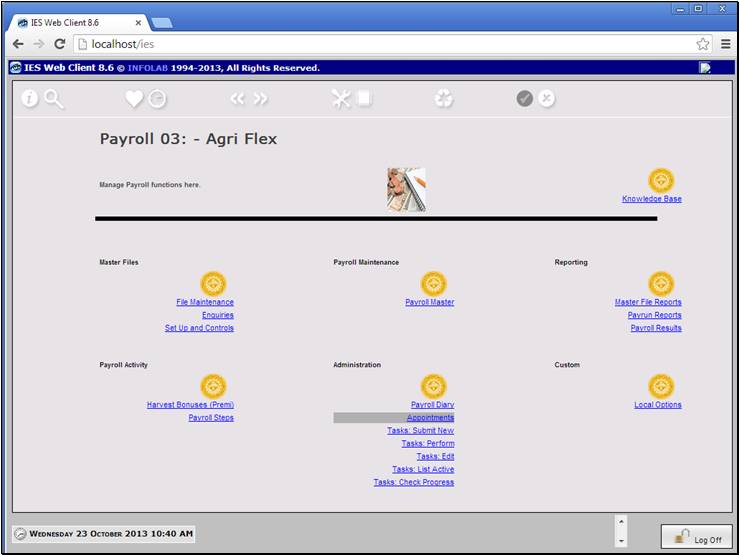

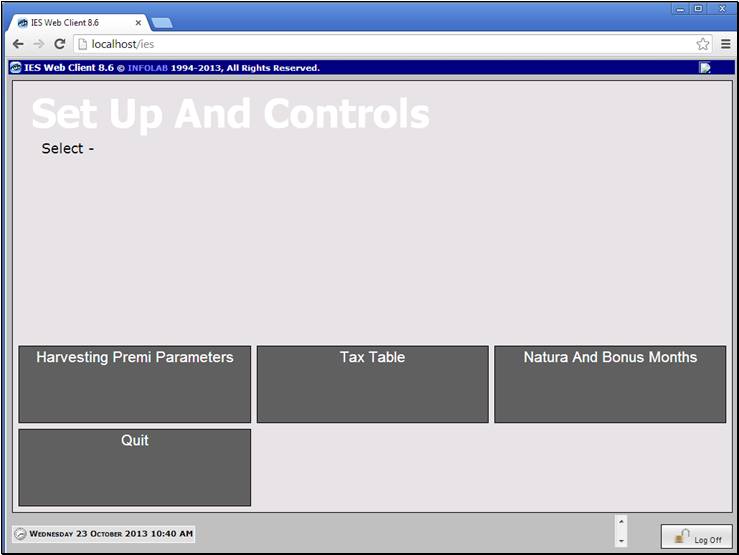

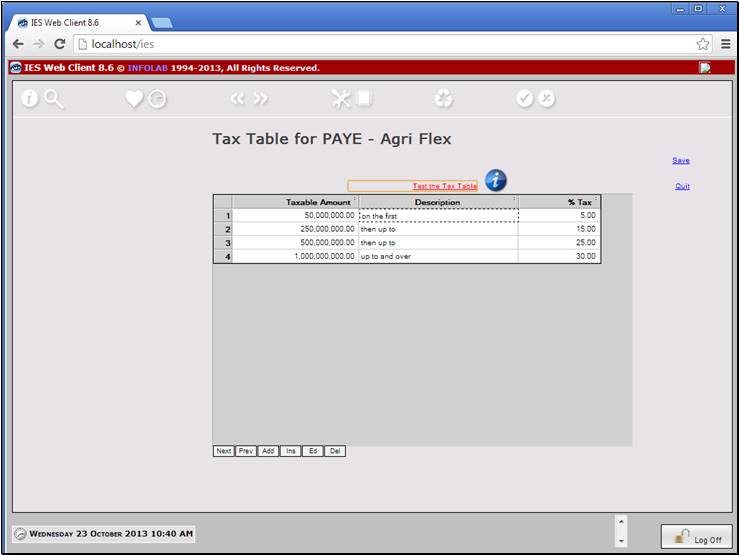

It is necessary to set up the Tax Table for

calculation of Tax deductions.

Slide 2 - Slide 2

Slide notes

Slide 3 - Slide 3

Slide notes

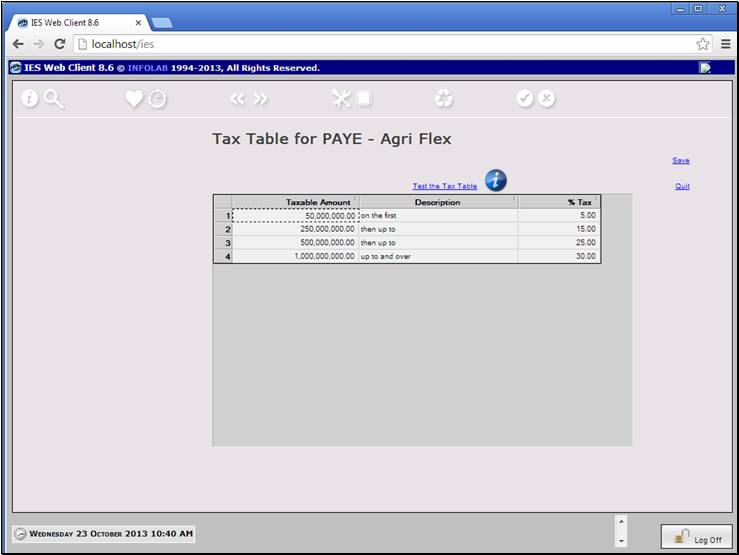

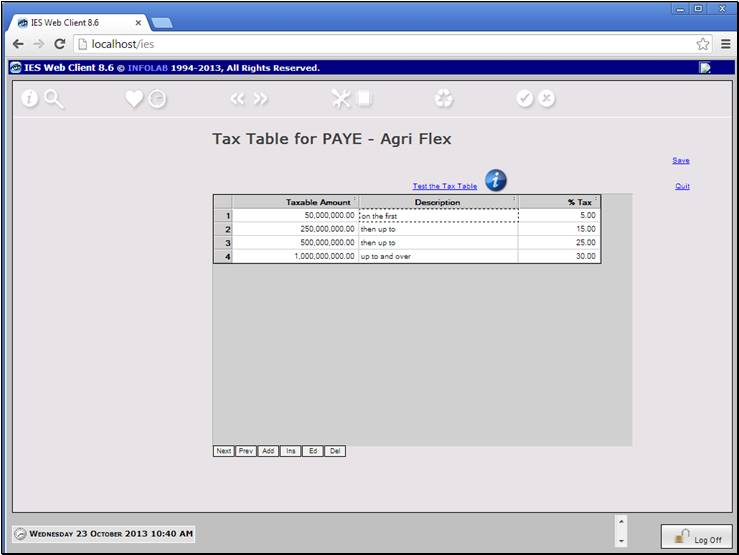

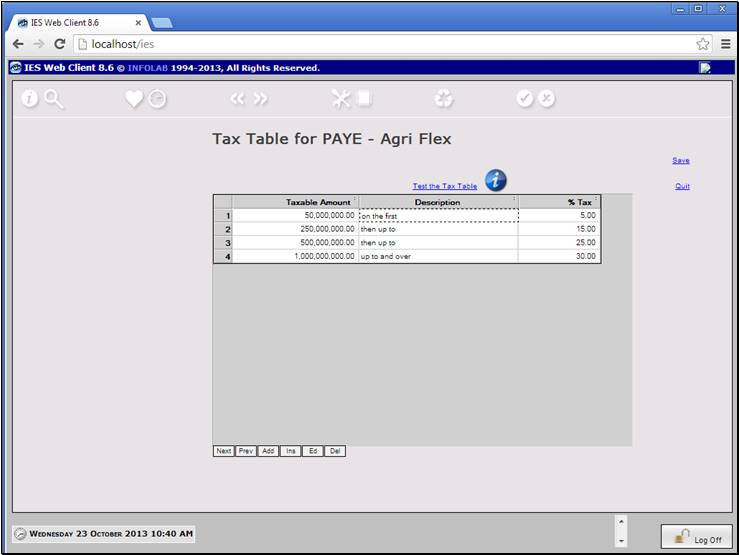

The Tax Table may be updated whenever Tax rates

change, and should be updated after completing the last run that uses the 'old

rates' and before the next run that must use the 'new rates'.

Slide 4 - Slide 4

Slide notes

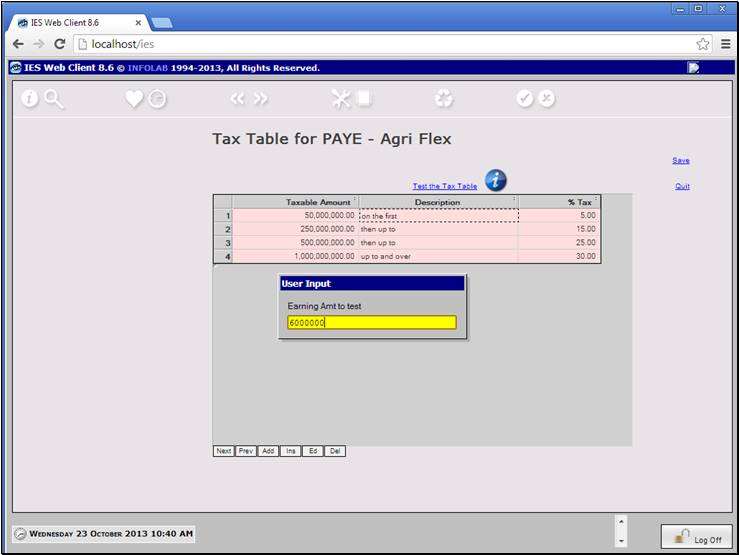

We also have an option to test the validity of our

input. By stating an Amount to be taxed, the system will return that Tax

Deduction, and in this way we can test whether we are satisfied with how the

Payroll will apply the Tax Table.

Slide 5 - Slide 5

Slide notes

Slide 6 - Slide 6

Slide notes

Slide 7 - Slide 7

Slide notes

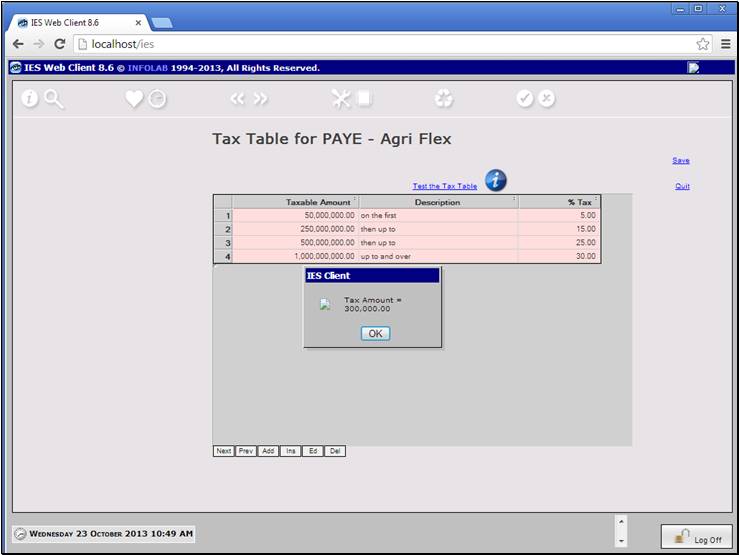

And this is the result.

Slide 8 - Slide 8

Slide notes