Slide 1 - Slide 1

Slide notes

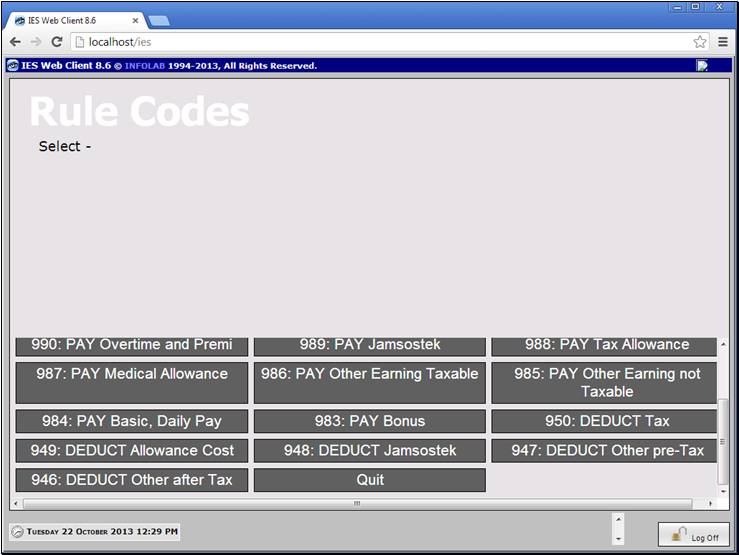

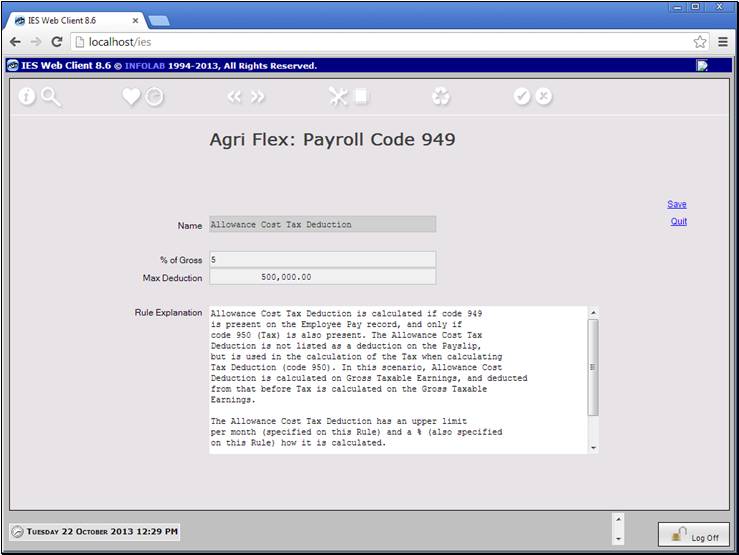

Pay code 949 for Allowance Cost is a Primary

Deduction code that can be loaded onto the Employee Status type.

Slide 2 - Slide 2

Slide notes

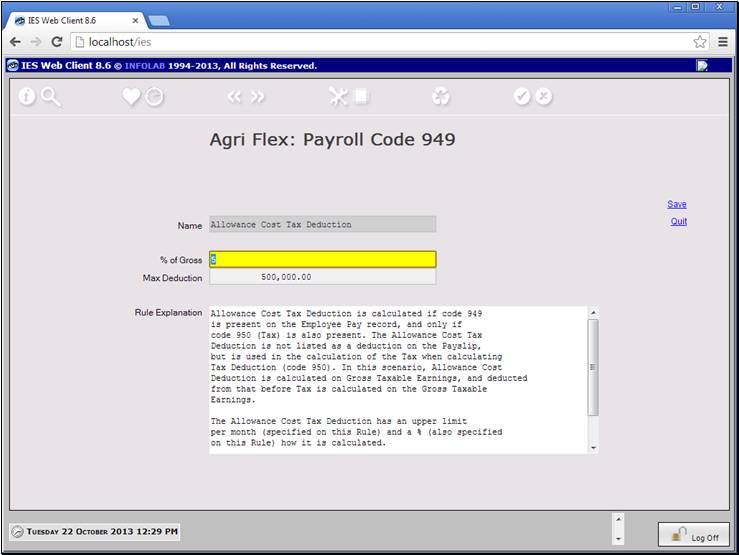

Allowance Cost is not a direct deduction, but

rather a Deduction in the Tax Calculation. When used together with Tax

Deduction code 950, an Allowance Cost Tax Deduction is calculated and deducted

from Gross before Tax is calculated on Gross.

Slide 3 - Slide 3

Slide notes

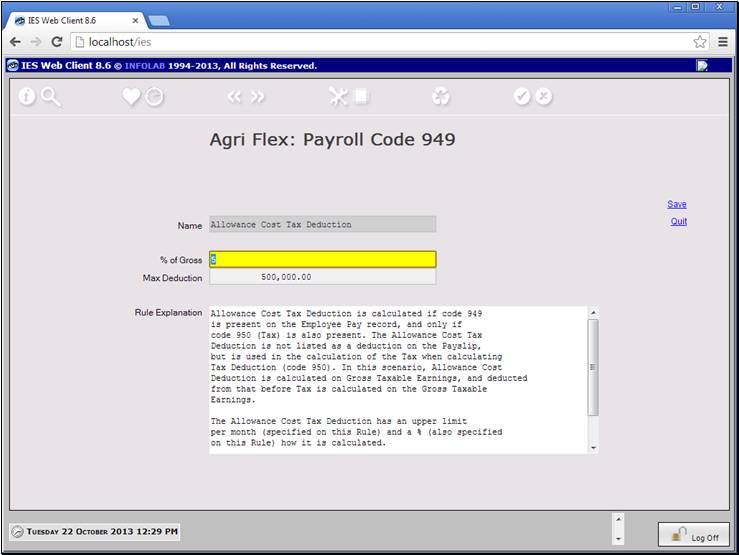

The Cost Allowance is based on a percentage of

Gross and is subject to a Maximum Amount, and both of these parameters may be

stated or adjusted on the Rule.

Slide 4 - Slide 4

Slide notes

Slide 5 - Slide 5

Slide notes