Slide 1 - Slide 1

Slide notes

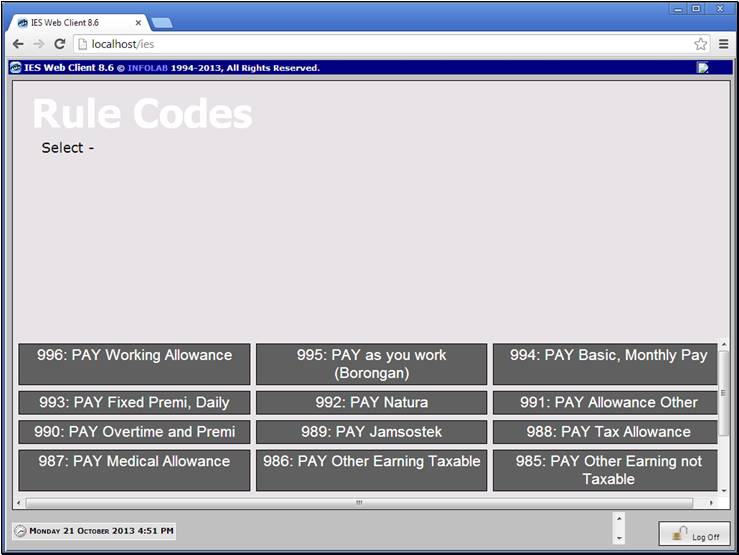

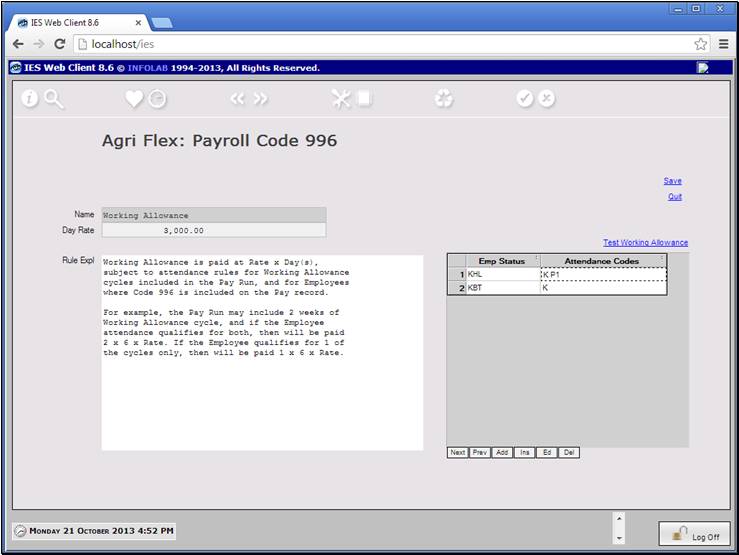

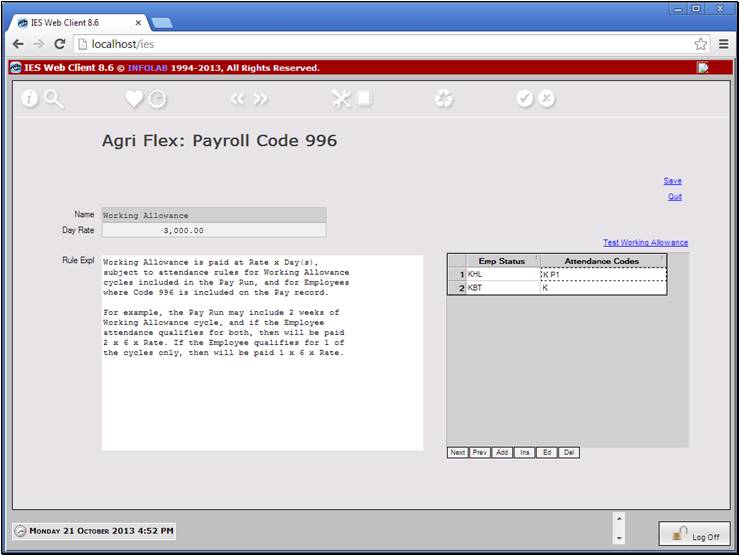

Working Allowance is a Primary Earning Code, and

loaded on the Employee Status type when we want to pay this type of Employee

the Working Allowance.

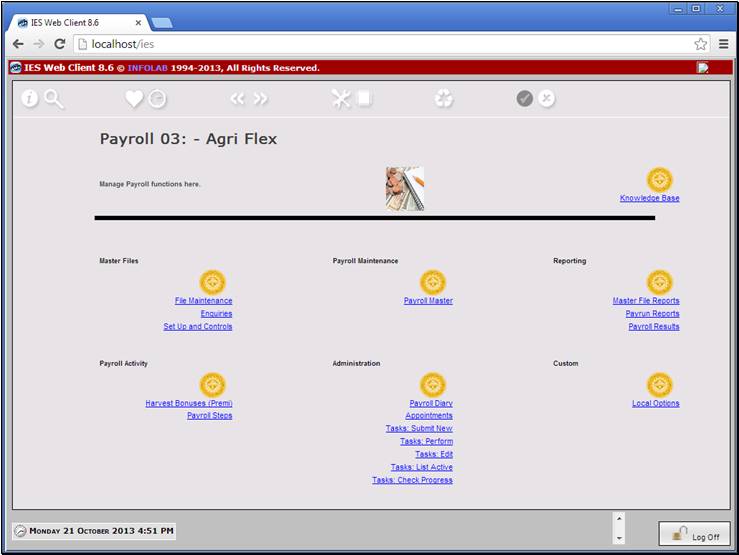

Slide 2 - Slide 2

Slide notes

Slide 3 - Slide 3

Slide notes

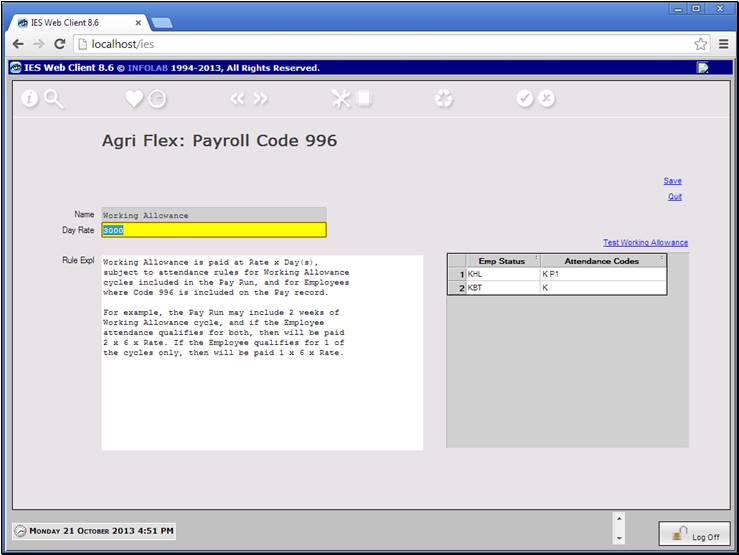

The Pay run will automatically know which Weeks

qualify for inspection of the Man Attendance records, and if the Employee

qualifies for any of the weeks, then will be paid the Rate x 6. The Rate may be

changed from time to time, if necessary.

Slide 4 - Slide 4

Slide notes

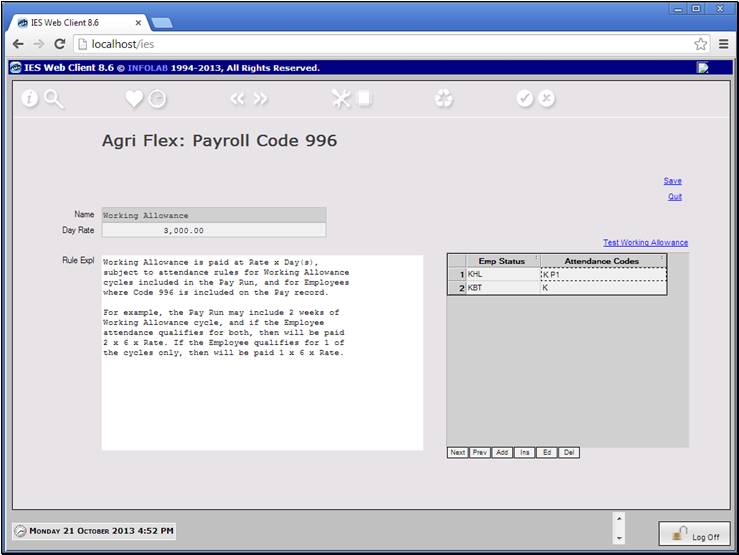

For Employee Statuses where the Working Allowance

will be included, it is necessary to list which Attendance Codes qualify as

payable attendance for Working Allowance. Then, if the Employee is in

attendance on such codes for Monday through Saturday, then will be paid Working

Allowance for that week.

Slide 5 - Slide 5

Slide notes

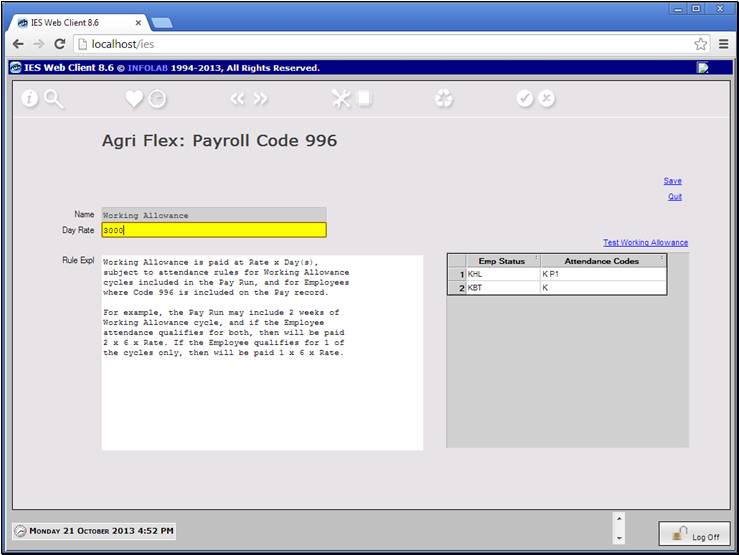

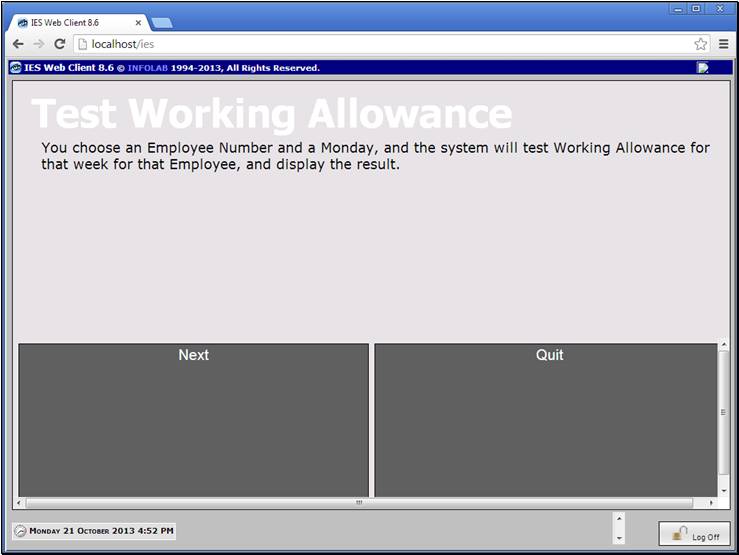

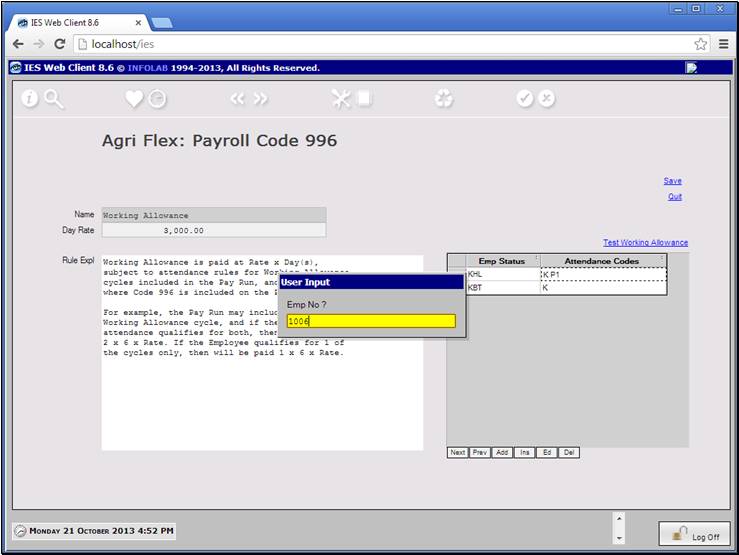

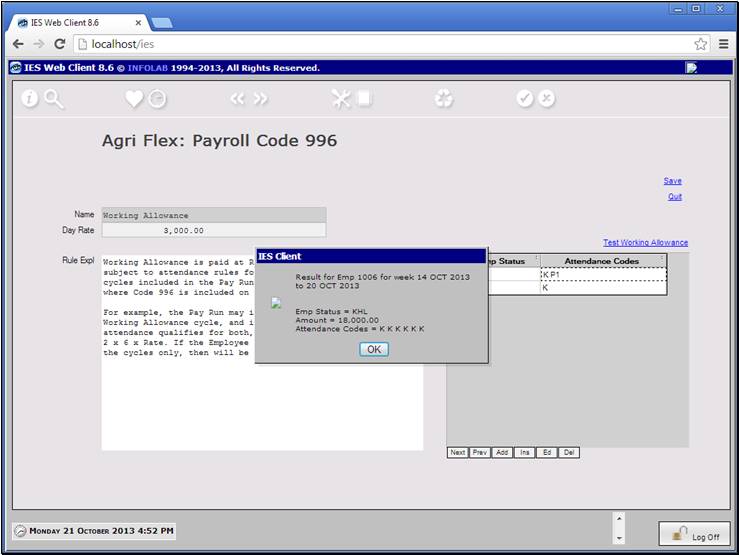

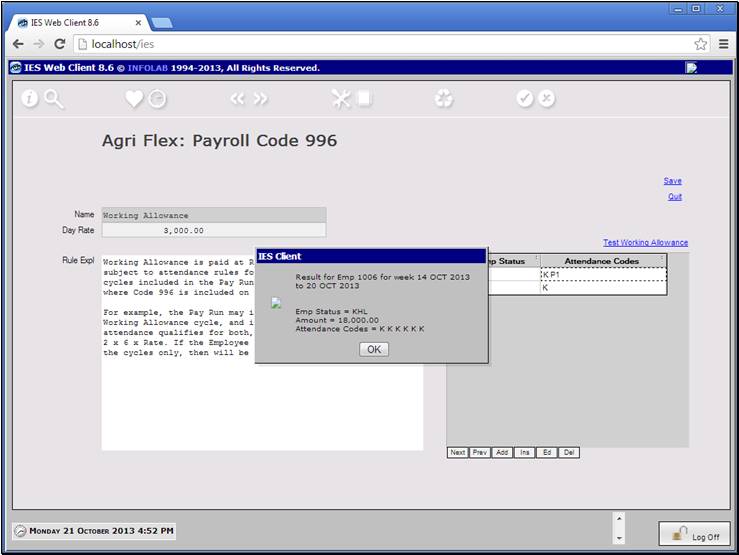

We can test the Working Allowance calculation for

any Employee from here.

Slide 6 - Slide 6

Slide notes

Slide 7 - Slide 7

Slide notes

Slide 8 - Slide 8

Slide notes

Slide 9 - Slide 9

Slide notes

Slide 10 - Slide 10

Slide notes

Slide 11 - Slide 11

Slide notes